🚨 Urgent FBA Update: Submit your claims by March 31, 2025 to secure maximum refunds

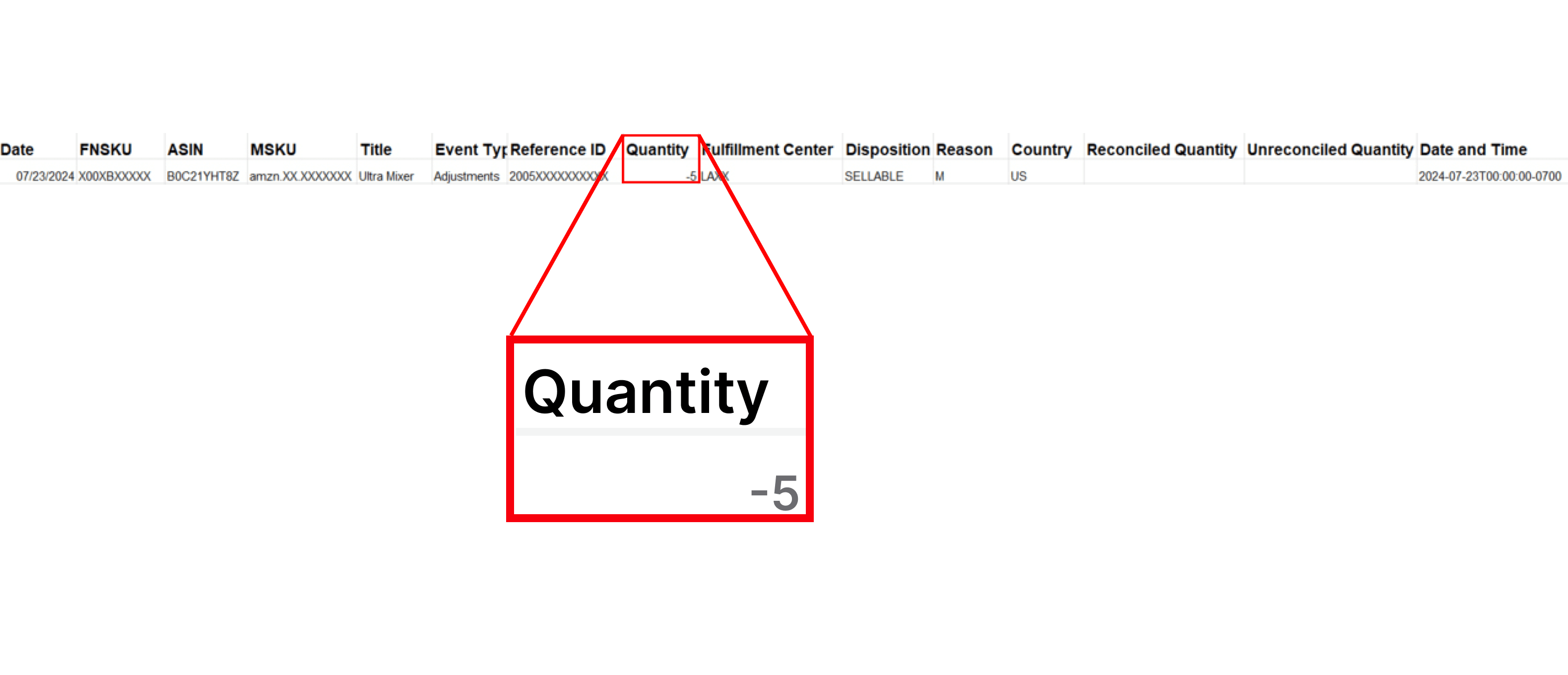

Rachel sells high-end kitchen appliances on Amazon. Recently, while reviewing her Amazon Seller Central Inventory Ledger Report, she discovered that five of her blenders were marked as lost.

Each blender is priced at $159.99. Concerned about the financial impact, Rachel submitted a reimbursement request to Amazon. Based on the price of each blender, she expected to receive a total of $799.95 ($159.99 X 5). However, when she checked the reimbursement report, she found that Amazon had only reimbursed her $724.95. Confused by the discrepancy, Rachel wondered why she had received less than expected. Why did this discrepancy occur?

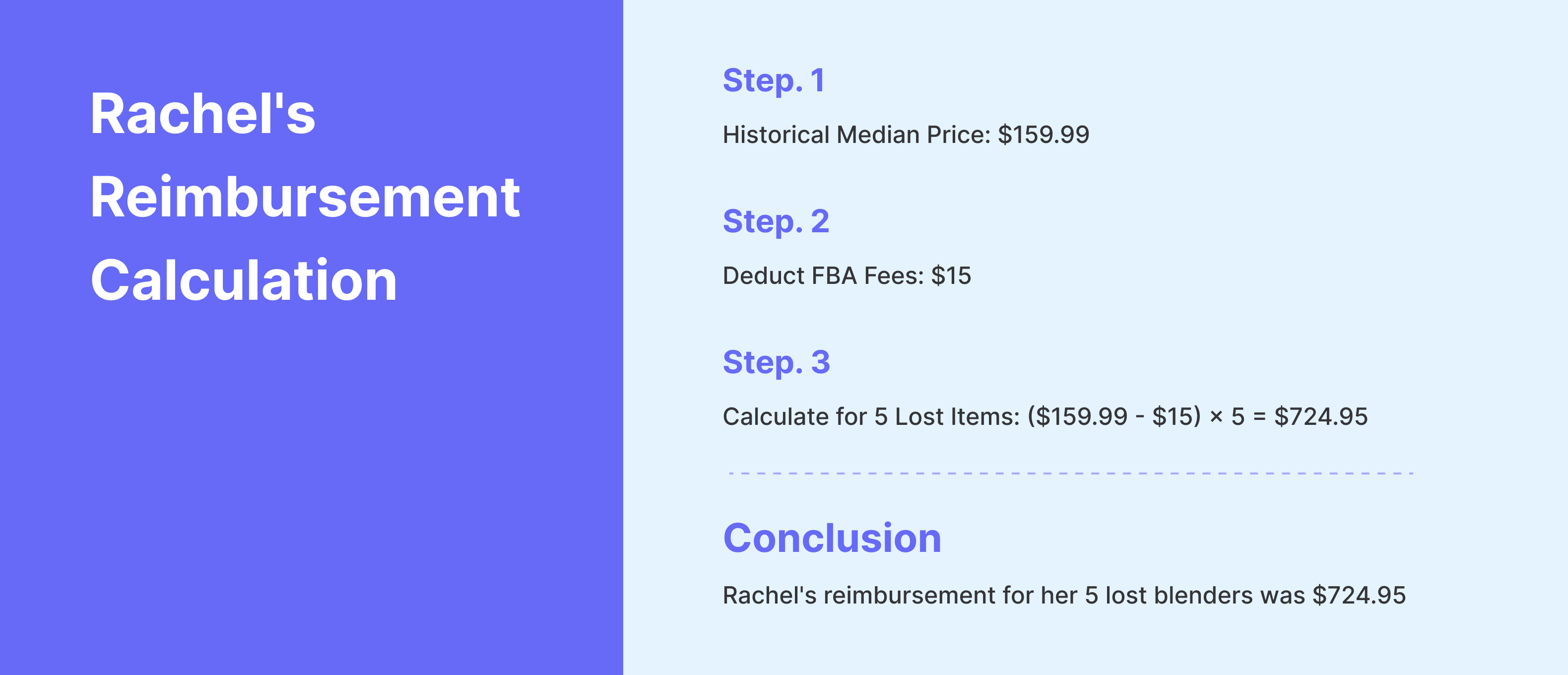

To understand why Rachel received less than expected, we need to look at Amazon’s reimbursement calculation process.

Sales Price and Reimbursement Amount: Rachel calculated her reimbursement by multiplying the sale price of the blenders by the number of units lost. She calculated it as “$159.99 X 5 = $799.95” but did not account for other factors.

Starting Calculation Based on Sales Price:

Rachel initially calculated $159.99 × 5 = $799.95, but this calculation didn't account for FBA fees.

Amazon deducts FBA fees before issuing reimbursements.

Verification of FBA Fee Deduction:

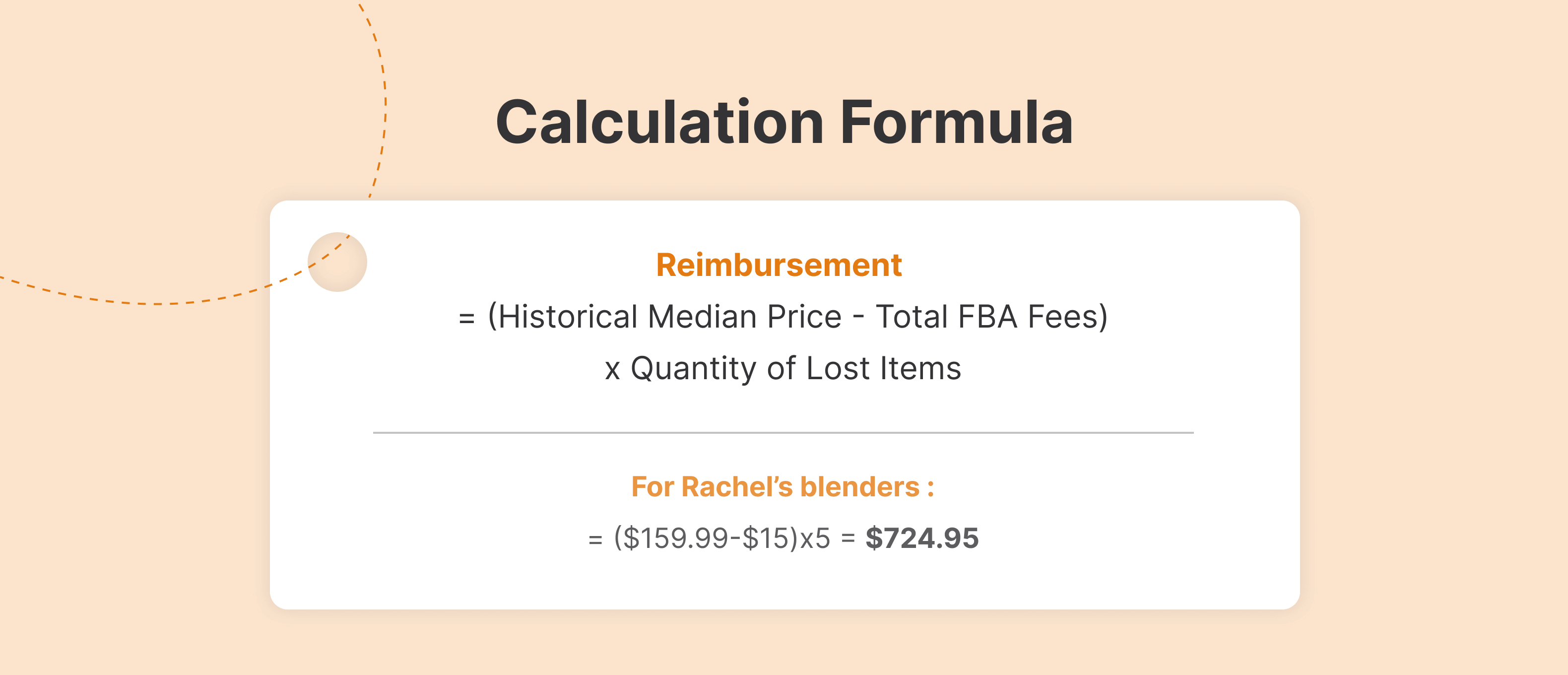

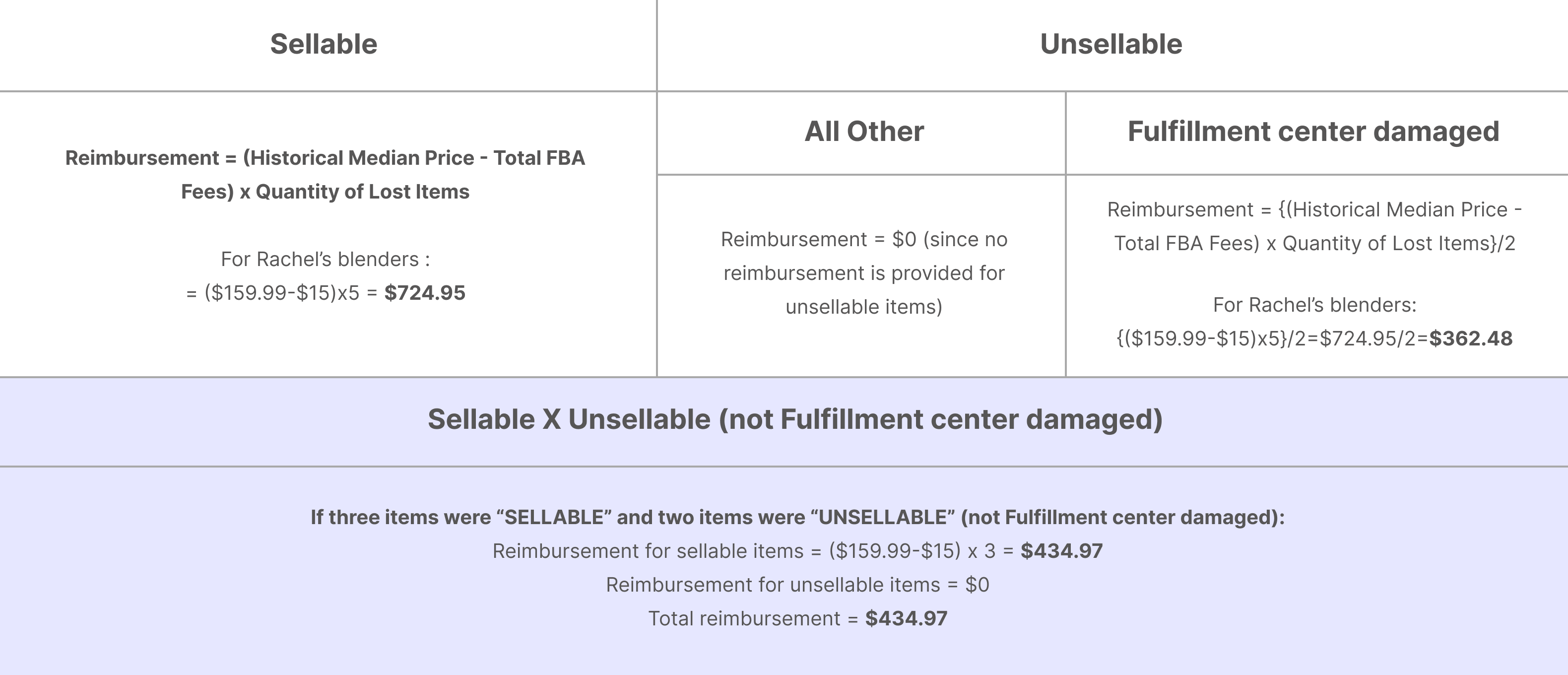

For items like Rachel's that are Sellable, Amazon calculates reimbursements as follows:

Reimbursement = (Historical Median Price - Total FBA Fees) × Quantity of Lost Items.

The median price is the middle value of a product's sale prices over a certain period. Amazon uses this to prevent inflated claims. In Rachel's case, she received the amount of $159.99 minus the FBA fees per blender.

Final Calculation:

By reviewing the Inventory Ledger Report and considering the FBA fee deduction, Rachel understood why the reimbursement was calculated at $724.95. Besides the sale price, Amazon uses various price comparison metrics to determine the final reimbursement amount:

• Median sale price on Amazon over the past 18 months

• Median sale price from other sellers

• Current or average list price on Amazon

• Current prices from other sellers

In Rachel's case, since the mixer price remained constant at $159.99, the primary factor influencing the reimbursement was the FBA fee deduction.

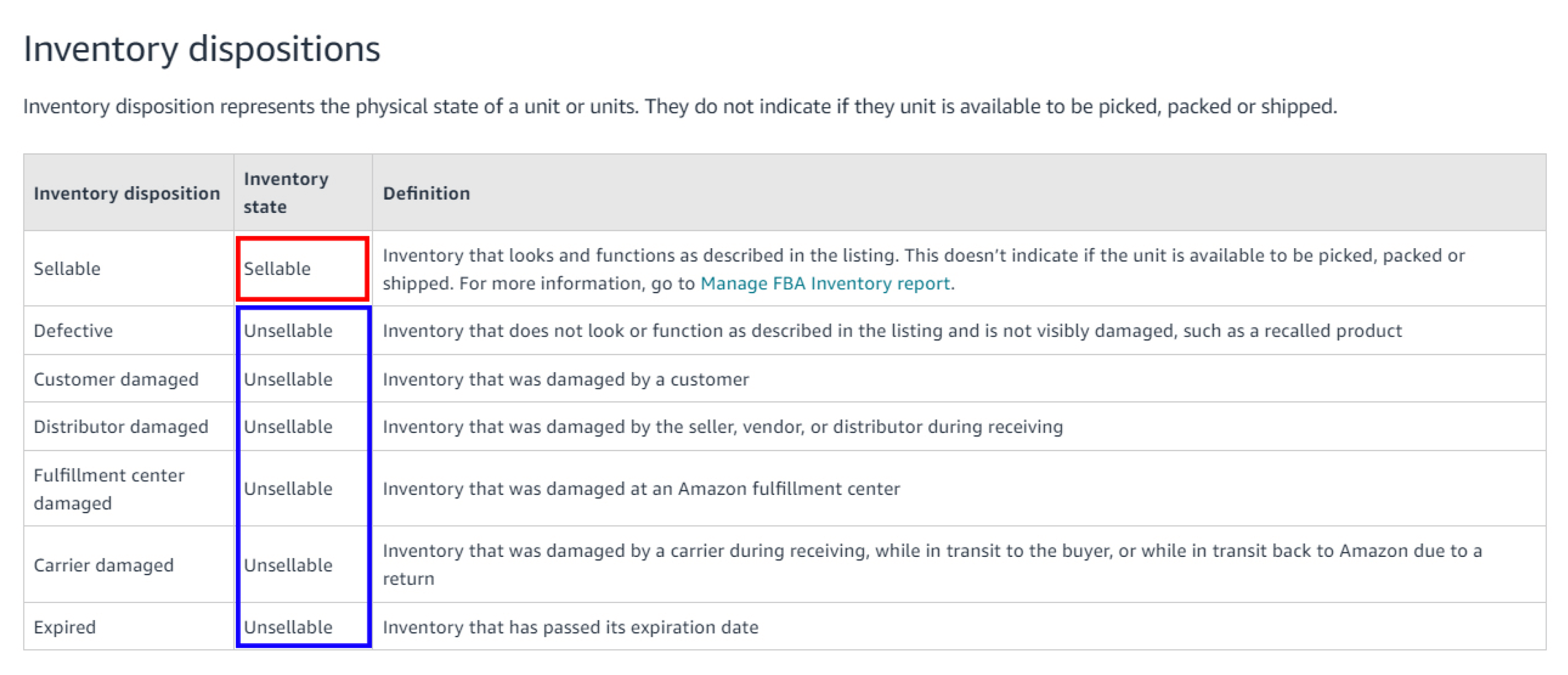

Inventory Disposition is divided into Sellable and Unsellable. For Unsellable items, the calculation differs based on whether the disposition is "Fulfillment center damaged" or not.

If the item is "Fulfillment center damaged":

You’ll receive half of the original calculation:

Reimbursement = {(Historical Median Price - Total FBA Fees) × Quantity of Lost Items}/2

For other Unsellable cases:

No reimbursement is provided, resulting in $0.

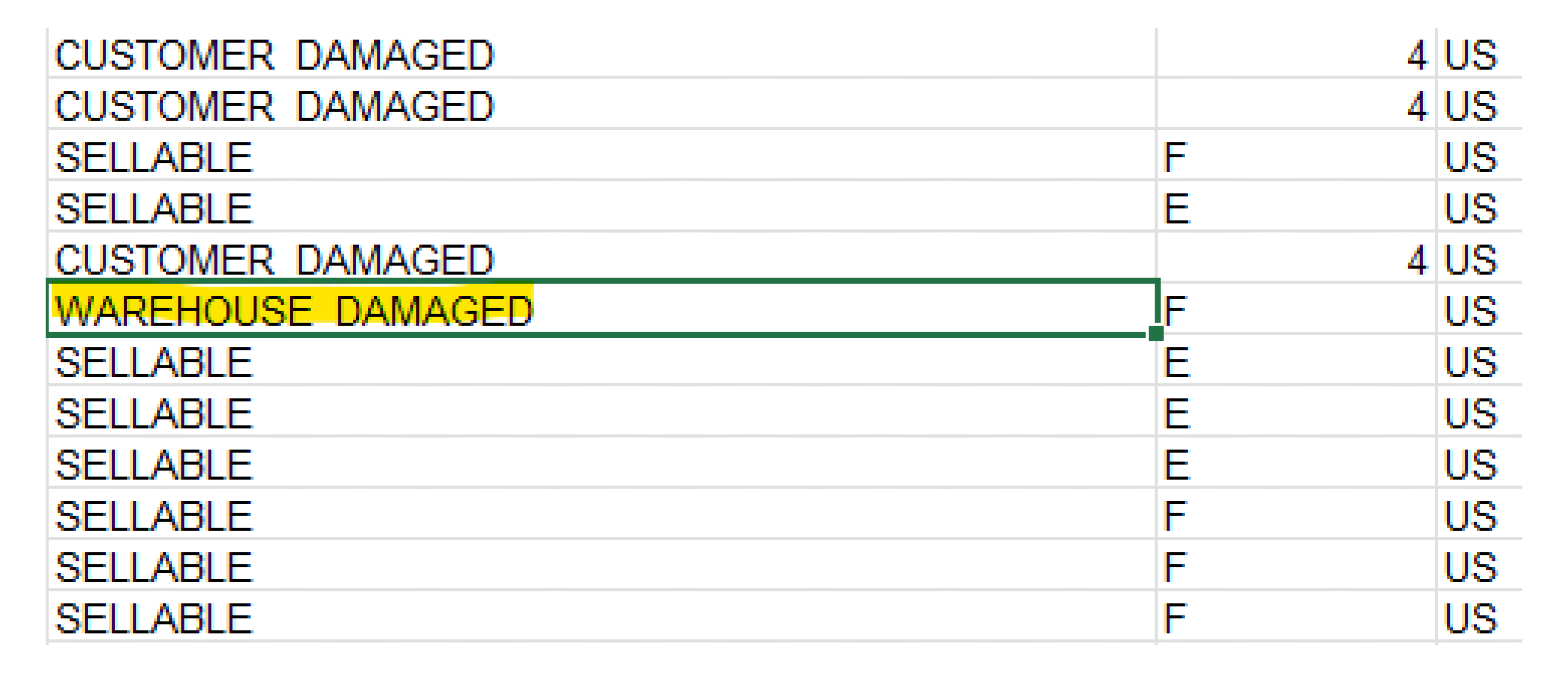

For reference, in the Inventory Ledger Report, the disposition column displays "WAREHOUSE DAMAGED" for items that have been damaged in the fulfillment center. Please note this when reviewing reports. However, throughout this document, we will refer to it as "Fulfillment center damaged" for consistency.

What if Rachel’s items were marked as Unsellable? In this case, the calculation would differ compared to Sellable items.

If Rachel’s items are Unsellable, how would the calculation work? It varies from Sellable items. Take note of the following.

If all five items were "UNSELLABLE" (not Fulfillment center damaged):

Reimbursement = $0 (since no reimbursement is provided for unsellable items).

If all five items were "UNSELLABLE" (Fulfillment center damaged):

Reimbursement = {($159.99−$15)×5}/2=$724.95/2=$362.48

If three items were "SELLABLE" and two items were "UNSELLABLE" (not Fulfillment center damaged):

Reimbursement for sellable items = ($159.99−$15)×3=$434.97

Reimbursement for unsellable items = $0

Total reimbursement = $434.97

Before requesting a reimbursement from Amazon, it’s crucial to understand their reimbursement policy. Amazon doesn't always provide reimbursement, so check if your situation qualifies:

• The item was listed in FBA when lost or damaged.

• It complies with FBA restrictions and requirements.

• Correct items and quantities were sent.

• The shipment was not canceled or deleted.

• The item was not pending or already disposed of.

• The item was not defective or customer-damaged.

• Your account must be in good standing during the review.

Important: The maximum reimbursement per item is $5,000. Consider third-party insurance for items exceeding this value.

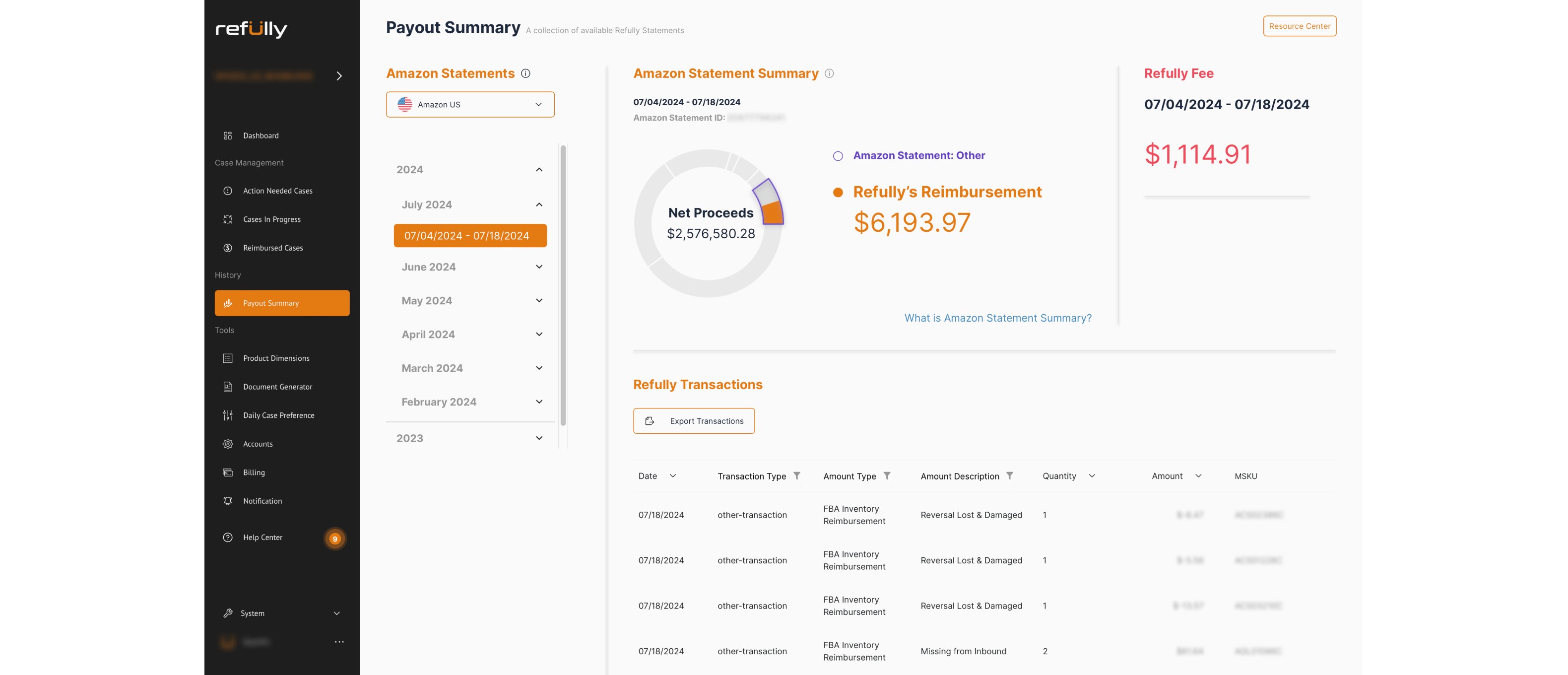

Understanding the factors that influence Amazon's reimbursement calculations is crucial for sellers like Rachel to ensure they receive the correct amount. Carefully reviewing the Inventory Ledger Report, considering FBA fees, and accounting for inventory disposition are essential steps in this process. These steps help avoid confusion and ensure accurate compensation. Tools like Refully can automate this verification process, making it easier to identify issues, file accurate claims, and confirm the correctness of received reimbursements. Simplify your reimbursement process with Refully!