🚨 Urgent FBA Update: Submit your claims by March 31, 2025 to secure maximum refunds

Learn the crucial steps to effectively audit Amazon FBA reimbursement claims. Discover how thorough auditing can recover lost revenue and enhance your business's profitability. Utilize expert tips and tools to streamline your reimbursement process.

Table of Contents:

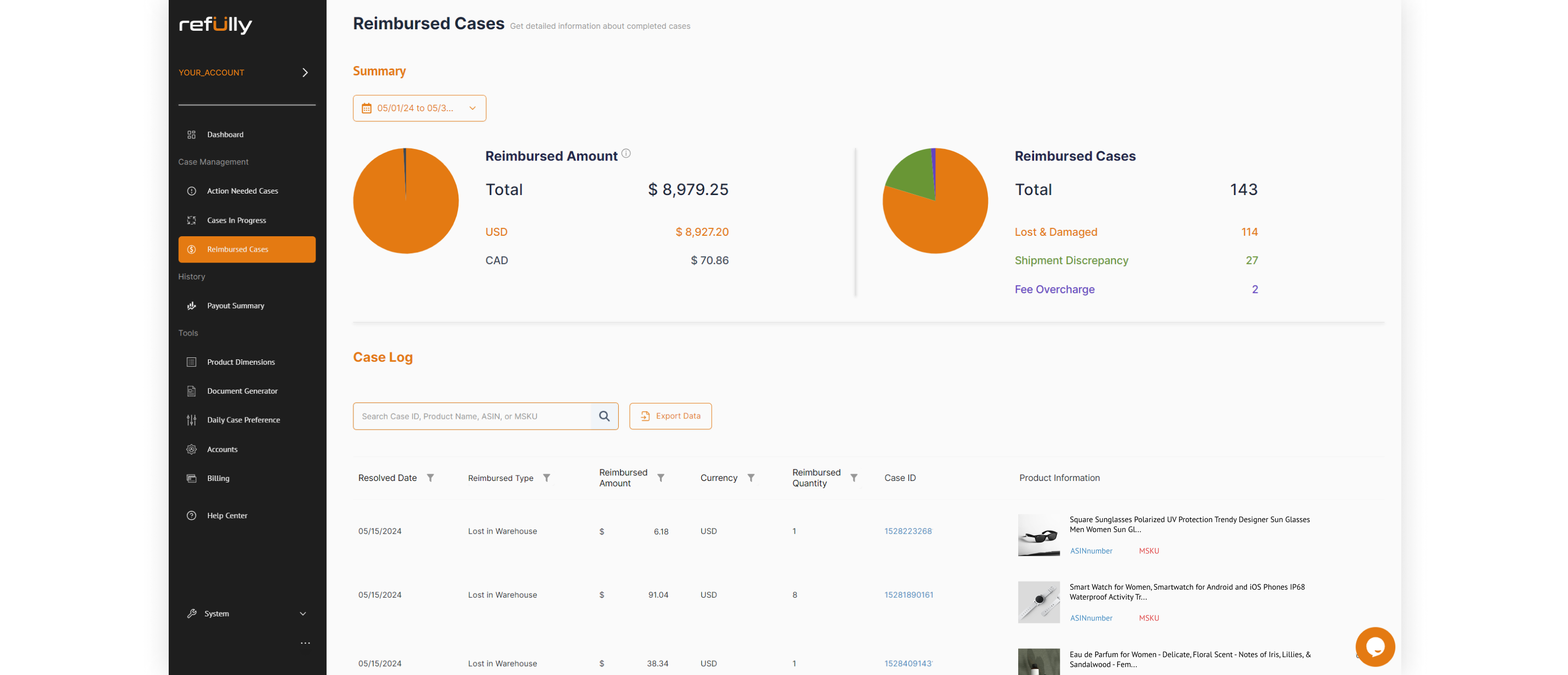

To streamline the auditing process and reduce the burden on sellers, leveraging technology is essential. Advanced FBA reimbursement software, like Refully, offers a range of features that make auditing more efficient and accurate. These tools automate the identification of discrepancies, track claims, and ensure that all potential reimbursements are captured. By using such technology, sellers can save significant time and effort, minimize human error, and maximize the recovery of lost funds. Additionally, these tools often come with user-friendly dashboards that provide real-time updates and detailed insights into the status of claims, making the entire process more manageable.

Amazon FBA auditing is a critical process that helps sellers identify and recover money lost due to inventory discrepancies, overcharged fees, and other errors in Amazon's fulfillment process. These audits ensure that Amazon’s records align with yours, uncovering potential reimbursements that Amazon may not automatically issue. Regular auditing helps maintain financial accuracy and optimize profit margins by addressing discrepancies proactively. Without auditing, sellers may unknowingly lose significant amounts of money due to unnoticed errors in Amazon's handling of their inventory and transactions.

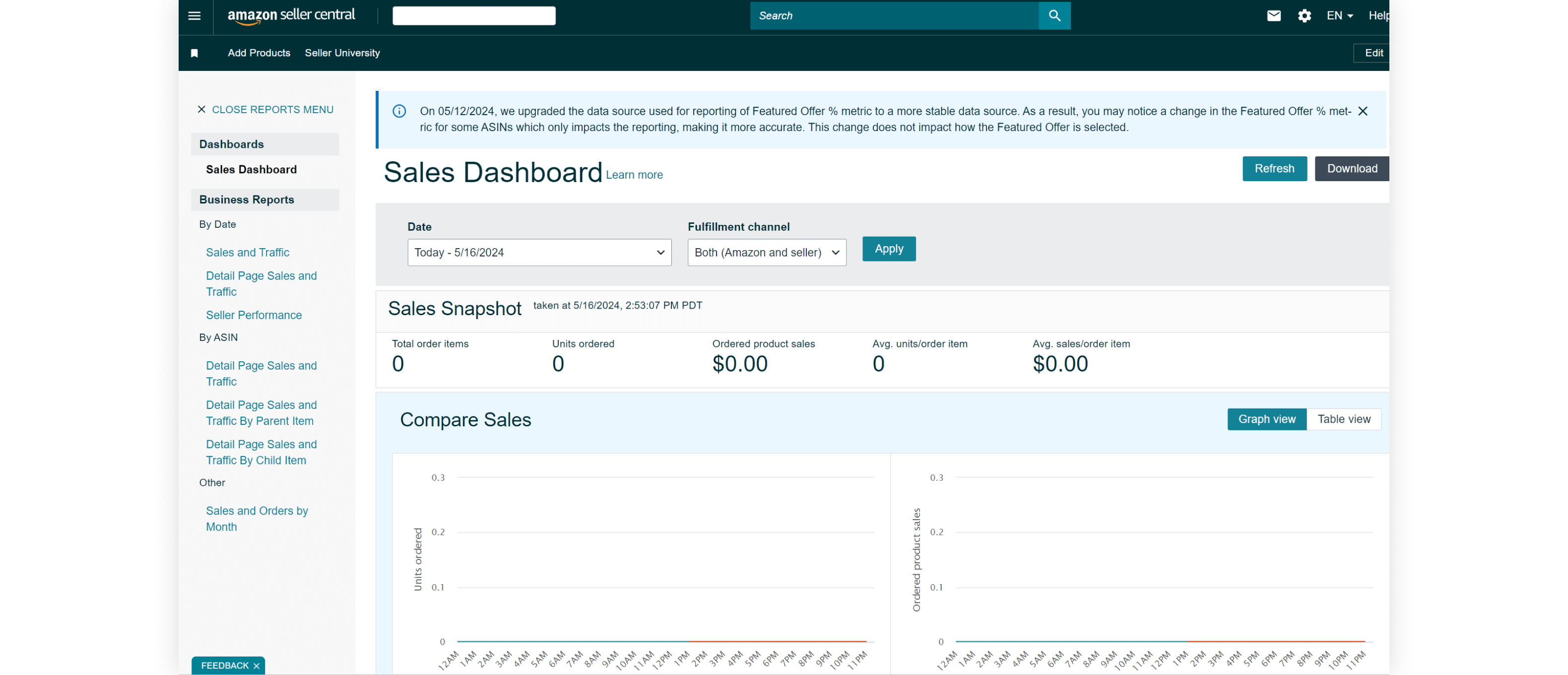

• Gather Reports: Start by collecting all relevant reports from Amazon Seller Central. Important reports include inventory reconciliation, fee preview, inventory adjustments, and fulfillment reports. These reports provide the data needed to identify discrepancies.

• Identify Discrepancies: Carefully compare your records with Amazon’s reports to spot any inconsistencies. Look for discrepancies in inventory counts, fee charges, and customer returns. This step requires meticulous attention to detail to ensure no discrepancies are missed.

• Document Evidence: Maintain detailed records and documentation to support your claims. This evidence can include invoices, shipping records, correspondence with Amazon, and photographic proof of damages. Proper documentation strengthens your claims and increases the likelihood of successful reimbursement.

• File Claims: Submit reimbursement claims through Amazon Seller Central. Navigate to the appropriate section, select the relevant discrepancy, and provide all necessary documentation. Ensure your claims are accurate and complete to avoid rejections.

• Follow Up: Monitor the status of your claims regularly. Follow up with Amazon if there are delays or additional information requests. Persistence is key to ensuring that your claims are processed and reimbursed.

Auditing can be a daunting task, given the complexities involved. It is time-consuming and requires a thorough understanding of Amazon’s systems and policies. Different types of discrepancies have various time limits for filing claims, adding to the complexity. Furthermore, ensuring accurate documentation and timely follow-up can be challenging, especially for sellers managing large volumes of inventory. Sellers must also navigate Amazon’s specific requirements for each claim type, which can be intricate and demanding. The need for constant vigilance and regular audits to stay compliant and profitable adds an additional layer of difficulty to the process.

Auditing can be a daunting task, given the complexities involved. It is time-consuming and requires a thorough understanding of Amazon’s systems and policies. Different types of discrepancies have various time limits for filing claims, adding to the complexity. Furthermore, ensuring accurate documentation and timely follow-up can be challenging, especially for sellers managing large volumes of inventory.

Why Use Refully?

Refully is a leading FBA reimbursement software designed to simplify and optimize your auditing efforts. Here’s why you should consider using Refully:

• Automation: Refully automates the process of tracking and identifying discrepancies. Unlike competitors who conduct audits weekly or monthly, Refully's advanced algorithms perform daily audits of your Amazon Seller Central account, flagging any issues that might warrant a reimbursement claim.

• Efficiency: By automating the audit process, Refully saves you significant time and effort. It handles the tedious and time-consuming tasks, allowing you to focus on other aspects of your business. As your business grows, the number of issues to handle will increase, requiring more resources such as manpower and time. Refully helps manage these growing demands efficiently, ensuring that you can scale your business without being bogged down by auditing tasks.

• Expertise: Refully’s system is built on deep knowledge of Amazon’s reimbursement policies. Its expertise ensures that claims are accurate, complete, and aligned with Amazon’s requirements, increasing the likelihood of successful reimbursement. Additionally, Refully continuously updates its system to reflect Amazon's frequently changing policies, ensuring that you can adapt to these changes and maintain compliance effortlessly.

• Maximized Reimbursements: With Refully, you can be confident that you’re reclaiming the maximum amount owed to you. The software’s thorough and systematic approach ensures no potential reimbursement is overlooked.

Amazon FBA auditing is a vital process for any seller looking to maximize profitability and ensure financial accuracy. By regularly performing audits and leveraging advanced tools like Refully, you can efficiently manage reimbursements and recover funds that might otherwise be lost. Integrating an effective FBA reimbursement service and software into your business strategy is not just beneficial but essential for sustained success. Regular audits not only help recover lost revenue but also improve inventory management, compliance, and overall profitability, making them indispensable for any serious Amazon seller.